Online Hacking for the Holidays

Credit bureaus vulnerable to modern day hacking

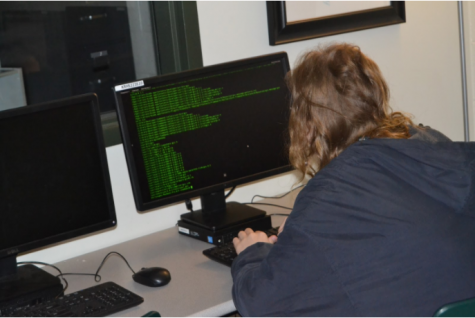

Junior Gavin Zeamer skims through codes and shows how easy it is to find information online.

Is your private information safe? Recent news about the major data breach in Equifax, a credit-reporting agency, reveal that it may not be.

According to Consumer Reports, Equifax, which collects information about people’s credit use, disclosed that “information of 143 million consumers were potentially compromised” after one of the most major data breaches in recent history. The breach was discovered on July 29, according to the company. This breach, according to Equifax, includes “names, Social Security numbers, birth dates, addresses, and, in some instances, driver’s license numbers,” as well as the credit card numbers for 209,000 U.S. consumers. In a recent Congressional hearing that took place on October 3, Equifax revealed that the number of people affected may have been as high as 145.5 million American consumers, which is about 45% of the country’s population.

Richard Smith, the former CEO of Equifax, represented the company in Congress. He apologized many, many times throughout the hearing, but many felt the company didn’t do enough to let the public know that the breach happened or even did enough before that and protect the information.

Representative Greg Walden said, “I don’t think I can pass a law that…fixes stupid.”

So how can one find out if his or her personal information was compromised or not? One thing Equifax did do was set up a website that allowed consumers to check if they were impacted or not.

They also announced that it would provide free credit monitoring to all U.S. consumers, which allows them to see how their credit is being used. Everyone, even if their personal information wasn’t compromised, can take part in this.

Another option is freezing your credit, which prevents anyone from taking out a loan or a credit card in your name, including yourself. It is the safest option according to many, but it requires you to unfreeze whenever you want to apply for credit, such as buying a car or applying for a job or a loan.

Librarian Mrs. McGilvery uses Lifelock, an American identity theft protection company. This is another option that protects against identity theft. Among other applications, Lifelock will also spend up to $1 million on the legal and associate fees needed to restore a customer’s identity.

Hackers can still find your personal information in public, such as at the mall. In a recent article on WTOP by Megan Cloherty, she suggested turning off the “Big Three” in public – Wi-Fi, Bluetooth, and location services. This is because hackers can find your information easier if you leave them on. However, using cellular data is still the safest option, and it is suggested as the best thing to use when doing any mobile shopping or banking.

As holiday shopping continues to expand throughout the virtual world, more and more people will be at risk and personal information will be available for those willing to hack it.